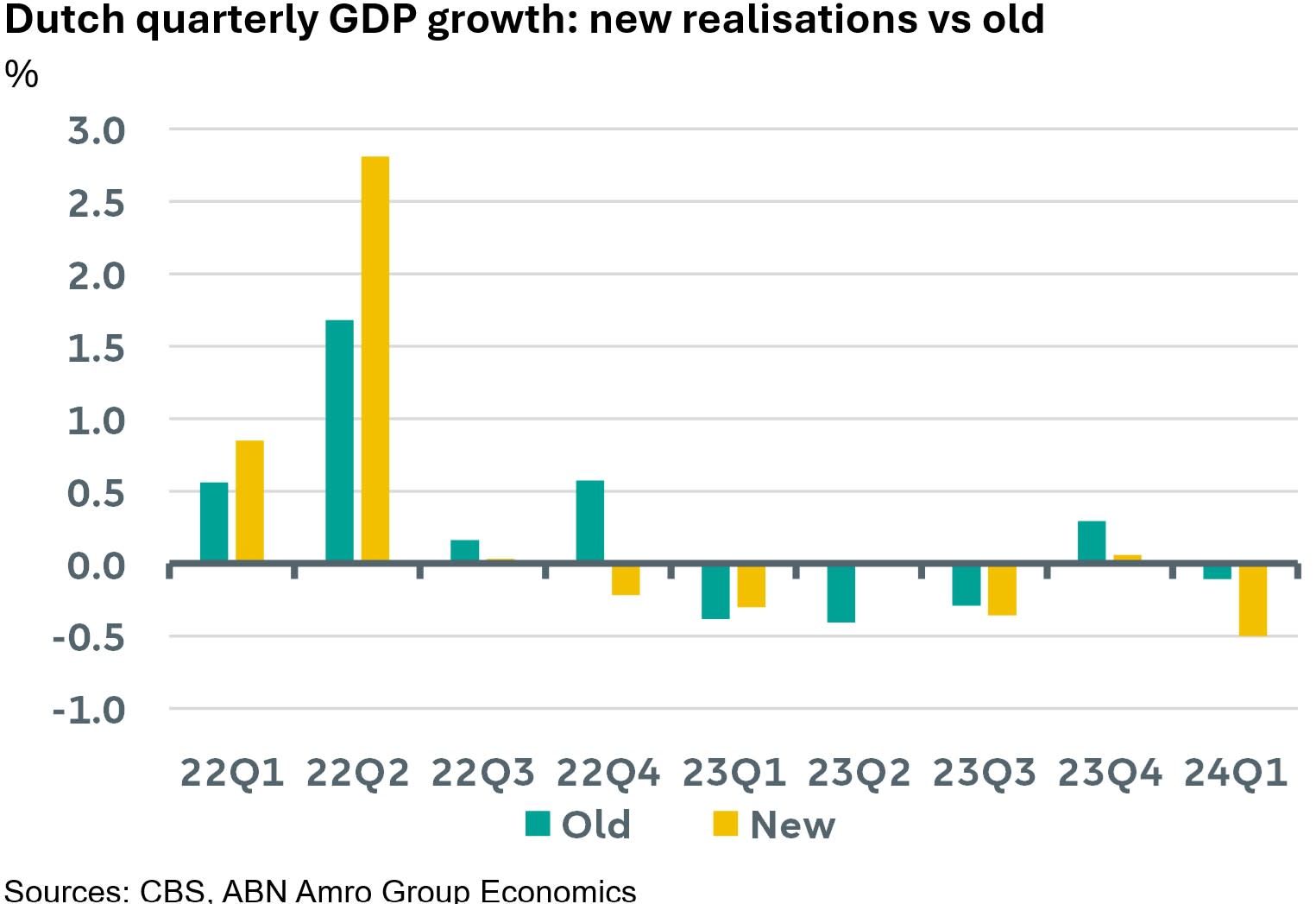

Het Nederlandse Statistiekbureau heeft vandaag de tweede berekening van de Nederlandse bbp-cijfers over het eerste kwartaal gepubliceerd. Hieruit bleek dat de kwartaalgroei in het eerste kwartaal -0,5% bedroeg, tegenover -0,1% eerder gerapporteerd.

In terms of subcomponents the difference was driven by lower government spending and lower trade volumes: both exports and imports were adjusted downward, with the higher exports change leading to a larger negative contribution to overall GDP. Next to Q1 figures earlier releases have also been adjusted.

The deviation (-0.4pp) is large by historical standards. In the last 5 years, deviations have been on average 0.1pp, including high volatility in the figures during the pandemic. What caused this? We see two reasons. First, in Q1 the model the CBS uses for seasonal correction is recalibrated. Due to this the Q1 adjustment is in our experience always relatively higher. Second, what has likely aggravated the previous point is the national accounting revision that Dutch Statistics Het is vandaag vrijgegeven en gepubliceerd. De nationale rekeningen worden periodiek herzien, waarbij nieuwe gegevensbronnen en methoden worden geïntroduceerd en de basis voor de bbp-cijfers opnieuw wordt gedefinieerd. Dit heeft waarschijnlijk bijgedragen aan de afwijking tussen het eerste en het tweede verslag. Omdat alle statistische bureaus in het eurogebied dit jaar herzieningen zullen publiceren – en het Centraal Bureau voor de Statistiek was een van de eerste – kunnen de afwijkingen tussen de eerste en de definitieve cijfers ook in andere landen iets groter blijken te zijn.

While the backward looking adjustment will negatively impact our growth forecasts (currently 0.5% for 2024 excluding today’s figures), it does not fundamentally change our view of the Dutch economy going forward. The categories responsible for the downward GDP adjustment, primarily exports, are not expected to add to growth in the near term. Indeed, the weakness in exports is caused by weakness in the Dutch and eurozone industrial sector and while we see signs of bottoming out here, a strong recovery in the short run is not expected. Instead, private consumption and to a lesser extent government spending are expected to drive growth in the coming quarters as real incomes rise on the back of lower inflation and high wage growth and the government supports purchasing power.

Overall, while we are still reviewing our forecasts, today’s realisation and revisions likely causes Dutch annual growth for 2024 to underperform the broader eurozone area as the Q1 figure of -0.5 contrasts with stronger than expected first quarter eurozone growth (0.3%).